cares act stimulus check tax implications

Medical Expenses For individuals who itemize their tax returns lawmakers extended a provision that allowed individuals to deduct qualifying medical expenses that exceeded 75 of their adjusted gross income. Thanks to the CARES Act over 80 million Americans got a stimulus check.

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

According to an HR Block study of small business owners fewer than 1 in 3 28 are confident that they understand the financial andor tax implications of receiving aid as a.

. Financial accounting and reporting-related implications. If you had 50000 in income and had a 5000 tax deduction your deduction would reduce your taxable income by 5000. NASFAA has confirmed with ED that Economic Impact Payments also known as stimulus checks stimulus payments or recovery rebates are neither taxable income nor untaxed income for Title IV purposes.

The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and. If you were in the 12 percent tax bracket youd reduce your taxes owed by 600 12 percent of 5000. The product of a swift bipartisan effort the CARES Act is designed to provide economic relief for businesses and individuals impacted by the ongoing COVID-19 crisis.

Updated September 2020 to add disclosure considerations related to various provisions of the CARES Act The Coronavirus Aid Relief and Economic Security Act CARES Act and Paycheck Protection Program and Health Care Enhancement Act Enhancement Act provide over 2 trillion in economic financial. The cares act allows for a five-year carryback of federal nols generated in tax years beginning in 2018 2019 or 2020 and removes the 80 taxable income limitation for nol deductions for tax years beginning before january 1 2021 ie it allows an nol to fully offset taxable income in the temporary window which is the period of time. It reduces your income which reduces the amount of tax you owe.

One of the features of the caa that most people know about is the stimulus check. None of the stimulus payments are taxable The IRS already has records of the stimulus checks in its system so taxpayers who are certain that they received the stimulus payments they were due. Tax filers taking a standard deduction may now deduct 300 of cash donations on top of their standard deduction.

Unwinding the stimulus bills reveals many tax implications Damon Knuppel PPP Forgivable Loan May be Taxable Income Under the Payroll Protection Plan PPP under the CARES Act CFOs of companies. How much money will I get. This change allowed these filers to benefit from charitable donations as well.

New York State tax implications of recent federal COVID relief. The Coronavirus Aid Relief and Economic Security Act CARES Act established the Coronavirus Relief Fund Fund and appropriated 150 billion to the Fund. The payments will not impact your tax owed for 2020 and will not reduce your possible refund.

Tax Implications Of The 2020 Stimulus Check And CARES Act. The Coronavirus Aid Relief and Economic Security CARES Act was signed into law by President Trump on 32720. Up to 112500 if you filed as head of household up to 150000 if married and you filed a joint tax return.

The stimulus check details are as follows. The 22 trillion stimulus package includes measures to help businesses hurt by the pandemic as well as direct payments to citizens who have been hurt by the pandemic. In 2020 the CARES Act provided some changes to charitable donations for taxpayers who take a standard deduction.

Up to 75000 if single or you filed taxes married filing separately. Tax implications of the 2020 stimulus check and cares act. They are ignored for all Title IV need analysis and packaging purposes.

Thanks to the cares act over 80 million americans got a stimulus check. The only information used to determine eligibility was adjusted gross income AGI. They are also not estimated financial assistance EFA.

Under the CARES Act eligible Americans who are out of work entirely or underemployed because of reasons related to coronavirus can receive an additional 600 a week for up to four months. Although the cares act was drafted to predominantly assist small businesses specific industries and health care professionals. Taxpayers who owe a debt to the IRS and are eligible for the stimulus check under the CARES Act are eligible to receive a payment.

Tax Implications of the CARES Act. If an exclusion applies an equivalent amount of any deductions basis losses or other tax attributes may have to be reduced in accordance with the Code or other Federal law. On March 27 President Trump signed into law the Coronavirus Aid Relief and Economic Security Act known as the CARES Act.

If you did not receive your coronavirus stimulus check despite being eligible for it. Here we outline 5 major tax implications that have stemmed from the new stimulus package. Single filers who make more than 99000 and joint filers with income exceeding 198000 are not eligible for stimulus payments nor are those over 16 who are claimed as dependents by their parents which includes many college-aged people.

See the full checks were only available to single tax filers with incomes up to 75000 and joint filers with incomes up to 150000 -- after which payments declined at a rate of 5 for each 100. Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes. The bill signed into law does not differentiate between a taxpayer who owes money and one who does not owe money.

But what are the tax implications for stimulus checks and unemployment benefits. But evaluating these tax impacts can be daunting. Individual taxpayers will be receiving a 1200 paymentCouples will receive 2400If you have a qualifying child 16 and under each child will add an additional 500Once taxpayers.

You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of. For married couples filing joint returns the income limit to receive a stimulus check is 150000.

Coronavirus Stimulus And Relief Program Guide Smartasset

His Name On Stimulus Checks Trump Sends A Gushing Letter To 90 Million People The Washington Post

Stimulus Checks For Us Expats Everything You Need To Know

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Coronavirus Irs Sends Stimulus Checks To Deceased Americans Warns Relatives Forgery Is A Federal Crime Abc7 San Francisco

Did Your Income Drop In 2020 Here S How You Can Still Get Stimulus Checks

Covid 19 Stimulus Checks Spurred Saving And Debt Payment More Than Spending Chicago Booth Review

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

Faqs On Tax Returns And The Coronavirus

Stimulus Check Do You Have To Pay Tax On The Money Cbs News

What Is Fiscal Stimulus Forbes Advisor

The Impact Of The Cares Act On Economic Welfare Bfi

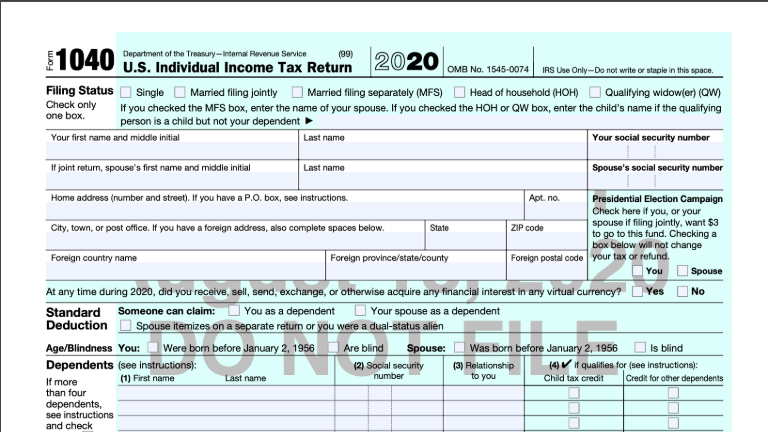

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

The Irs May End Up Sending Two 500 Stimulus Checks For The Same Child In Split Homes The Washington Post

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

The Impact Of The Cares Act On Economic Welfare Bfi

Impact Of The Coronavirus Stimulus Checks On The Economy Julian Samora Research Institute Michigan State University